Hey there.

Today’s topic (raising money) might not be one that comes to mind when you first think about brand marketing, but for many early-stage companies, pitching to investors and raising money is as much art as it is science. Even the numbers, financials, and projections are usually rooted in narrative first. The best story doesn’t always win, but it does more often than just the best product or technology.

A concise pitch and compelling narrative are required for raising capital unless you have an incredible, 10x innovation (and even then, you still need to explain it well enough to your early adopters).

Fundraising is, without a doubt, the area of the startup world that we have learned the most over the past decade in startup land, and through hundreds of decks and investment memos, successful and unsuccessful pitches, we have seen firsthand the role that marketing needs to play to improve a company’s chances at securing funds from investors.

Are we biased as marketers? Sure. Are we right? We think so.

Raising capital is harder than ever right now, which means that an early focus on brand as a competitive advantage is more important than it used to be.

Let’s get to it.

Jeff

Disclaimer: Approximately zero percent of this newsletter was written or aided by ChatGPT

The stages of funding

Startup jargon is like most other jargon: used too much and not defined properly. I’m going to be reductive with these definitions for the sake of context-setting.

The classic startup path, from a venture fundraising standpoint, is this:

Seed Round: Usually a smaller round between $500k-$1 million made up of strategic and angel investors (individual people).

Series A: The first “institutional” round. Investors are usually more discerning (due diligence is the operative term) as the check sizes get bigger. Series A raises range widely, but for the sake of simplicity, let’s say at this level, most companies are looking to raise between $5-10 million. Typically, venture capitalists enter things here.

Aside: there was a trend during the pandemic for massive Series A rounds of $50-100 million. There is one rule of startups that says: take the capital if it is there, and another rule that says: only raise what you need. The cash was there in 2020-2022, and in most cases, it isn’t right now.

In our experience, both of these rules can be right and wrong, depending on how a company manages its cash. We have seen companies raise too much and flame out, and companies raise too little and limp along while hamstringing their potential growth.

After a Series A raise, companies can go a few directions. Typical venture-backed companies had a growth-at-all-costs mentality before The Great Correction, which led to subsequently bigger rounds: Series B, C, D, and so on. Generally, anything beyond Series C means that a company is either incredible (Stripe) or good at tricking new investors.

Exit/IPO: At some point, companies still alive can then decide to go public (via IPO - initial public offering on the stock market) or get acquired by another company, or the rarest option of all - achieve profitability and stay private.

This is a very basic explanation, and it has also changed quite a bit over the past few years.

Many companies are doing smaller rounds before a Seed Raise, and the Seed Round itself has been split up into Pre and Post-Seed (you can see where marketing is needed).

A lot of companies that launched close to or during the pandemic raised capital at terms and valuations that are proving to be impossible to live up to, which has led to many stealth rounds (otherwise known as flat, or down, rounds) - raises that are not worth sharing publicly but help the company to keep the lights on and stay the course. Most times you see a funding announcement with no dollar figure included, this is what is happening.

The Three Horizons (and why they all matter for raising money)

Enter marketing.

We typically work with Seed and Series A companies, and there is a wide range of marketing needs early on. Thankfully, some consistencies make it easier to bring structure to the marketing function. Typically:

Some capital has been raised (Seed or Pre-Seed Round)

Early traction/product-market fit has been achieved (at least a few paying customers if B2B)

Some idea of who the target customer is (emphasis on ‘some’)

Companies at this stage are still small and scrappy, and the marketing mindset needs to reflect this. Solving problems. Helping close deals. Building websites. Creating content and assets. Marketing needs to operate like a Swiss army knife and often evolves to support fundraising, too.

Disclaimer: my goal with these newsletters is to inform and not to sell, but part of why we picked Three Horizons as the brand is it perfectly aligns with our marketing approach, which includes raising capital.

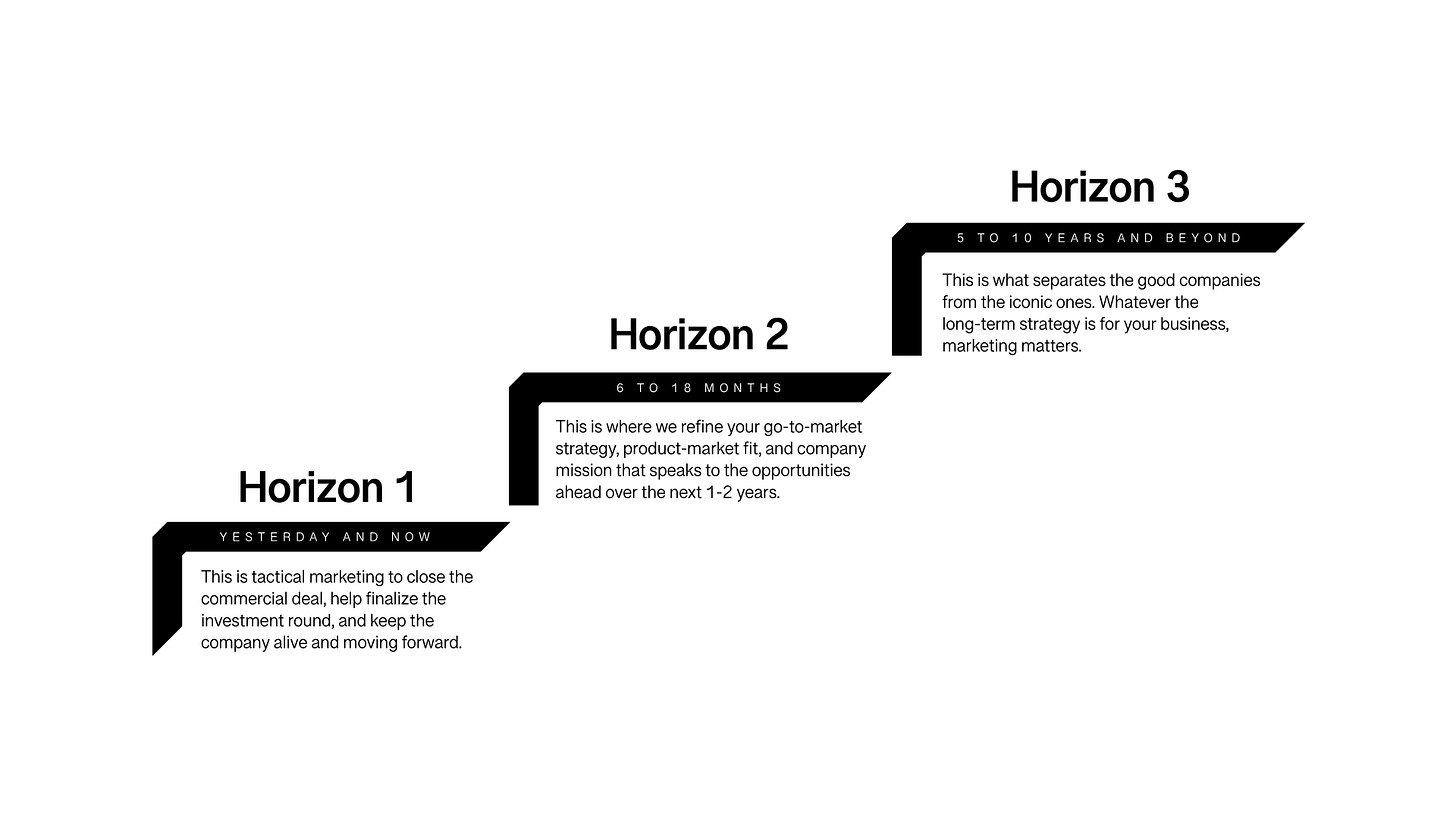

Horizon 1 (now): this is the marketing to build momentum and awareness in the market. Press, social, e-mail, website, it all fits in here.

From an investment standpoint, this is where you earn trust and credibility.

Horizon 2 (1-2 years): this is the marketing that helps to build the business. This horizon of focus matters a lot to investors at every level and more than it did a few years ago. Path to profitability, go-to-market momentum, scalability. It all fits in here.

From an investment standpoint, this is showing how you’ll use the funds you are hoping to raise, and what you have proven to date to show that you know what you’re doing.

Horizon 3 (5+ years): for most early-stage companies, this is still the most important horizon in terms of the marketing => fundraising connection. How could your company be a massive success? Early-stage investors are looking for big ideas that could lead to big wins.

A common mistake companies make is to either over-index entirely on Horizon 2 (without showing an exciting long-term vision) or Horizon 3 (without showing traction and some early business fundamentals that can scale).

The marketing foundation (what you need)

I have written about each of the below items before but wanted to bring them together to form a ‘marketing playbook’ for fundraising.

Brand early, brand often

First up: you need to build a brand. This used to be something you could push off until later, but now you must have a polished and refined brand as early as possible. Here’s an essential read on how to build a startup brand from Rex Woodbury.

“Brand is an investment, not a cost.”

Essentials for your investment deck

I heavily borrowed the below criteria from Andy Raskin.

Name the enemy (as big and large as possible - similar to the above but can be more aspirational)

Why now? (perhaps not right now, but investors generally have FOMO across the board)

Tease the promised land (if everything hits, what does the future look like for your company)

Introduce macro-level obstacles and how you can overcome them (different than the sales deck - these are preconceived obstacles in society)

Present evidence (traction, testimonials, product-market fit)

Everything else is optional, but your pitch to investors at this early stage needs to include all of these things in some capacity.

PR matters

I have seen well-placed and well-positioned PR, whether it was earned (free) or paid for (wire service, pay-to-play article) have a significant impact on financing and investment.

I haven’t seen the same direct correlation on sales, but startups that consider PR a “later” activity need to know that it will likely impact how easy it is for them to raise money.

Consistency in message and consistency in the market. Both matter.

The strategic narrative

Spend the time on this early. Revisit it often. Having a clear vision and mission, and a company elevator pitch (written down, circulated, and understood internally) will help you raise money.

Vision statement:

What does the world look like in 10 years if your company is a massive success?What impact have you had? A vision statement should be lofty, aspirational, and bold. It does not need to be unique to your company, and can be a bit vague and general. Without getting too prescriptive, it should be shorter than your mission statement.

Mission statement:

What are you doing over the next 1-3 years to get closer to realizing the above vision? Generally speaking, the earlier-stage your company, the more descriptive your mission statement can and should be. You need to define your market (whether you are creating a new one or entering an existing one as a disruptor), who you are for/not for, and what you actually do. Ideally in clear and concise language with no sales buzzwords (avoid using revolutionary, game-changing, best-in-class, and so on).

Boilerplate:

This is the 4-6 sentence “about us” elevator pitch that lives at the end of a press release and in your investment memos. It should include your vision and mission, and more information about your company - list our your customers, investors, and go into greater detail on what you actually do.

Marketing as the quarterback

Bringing it all together, it is clear to see where marketing is needed in the process of raising funds. For most early-stage companies, securing investor interest (and money) is a mix of selling them on your innovation and selling them on your business.

The better the technology, the more you can focus on the innovation. The last few years have seen a correction in business fundamentals, so most companies need to present some semblance of sound business fundamentals, or at least a path toward them.

Marketing is most effective when it acts as the gatekeeper for communications, brand development, and overall positioning. These are all foundational to the materials you need to get in front of investors, including your financials and projections.

Not only does marketing need a seat at the table when it comes to creating your investment materials, but we believe that the function should operate as the quarterback of the (very collaborative) process.

Yours in marketing,

Jeff